working in nyc living in pa taxes

- The New York Times. The city is a place everyone wants to work in but many choose to not live here therefore the resident taxpayers of the city must subsidize many services these people enjoy when they work in the city.

10 Pros And Cons Of Living In Pennsylvania Right Now Dividends Diversify

There are rules governing taxation of people working remotely for in-state and out-of-state employers.

. A resident return to NJ. Youll be taxed by NY for your NY earned income at least NYC tax doesnt apply to non-residents so itll just be NY state taxes on your wages. So the New Yorker who decamped for months to her Vermont vacation home and worked remotely for a New York-based employer is likely to owe income tax both to New York and Vermont Noonan said.

Also every city worker should live in the city so their tax level should. Wiki User 2009-06-23 190721. A non-resident return to NY and.

Actually I found that it is between Pa and New Jersey and other states. Worst of all this means that I have not paid New York. For example NY withholds 10K but in NJ that income tax would have been 7K then I end.

There are rules that will trigger. Answer 1 of 11. As part of the working out of state tax rules when filing a non-resident tax return youre only required to report and be taxed on the income.

When this is the case your resident state PA will give you a credit for the tax you must pay to NY on your income. I live in NJ but work in NYC. I heard of the term Reciprocity and thought it meant that you only need to file taxes in the state that you live in and it was between Pa and New York.

After working in the US for over 20 years and paying taxes even though they can never benefit from social security they still cannot catch a break. I brought m y house in 2007 and in nys i payed for taxes in 2008 and now in 2009I lived in pa for about two years now i will be working in nyc for a little whils and when i transfer ill be in paI want to chaNGE MY TAX. Answer 1 of 6.

The cost of living in Philadelphia PA is -370 lower than in New York NY. Located at the southern tip of the state of New York the city is the center of. This means for example a Pennsylvania resident working in one of those states must file a return in that state pay the tax and then take a credit on his or her Pennsylvania return.

You could be looking at a. This means for example a Pennsylvania resident working in one of those states must file a return in that state pay the tax and then take a credit on his or her Pennsylvania return. The way my taxes work are pretty simple.

Hi I have question with respect to your state tax PA return. You pay out of state income taxes to the State of NY on portion of income earned in New York imagine if you were a professional baseball player and all the state tax returns youd have to. Living in One State Working in Another Need to file state taxes when you live and work in different states.

I work in New York and lived in New York. NY does have a higher tax rate than PA so it is likely you do not pay PA tax at the time you file your return. Where do I pay taxes if I live in PA but work in NY.

Sette Luna on Ferry Street a few blocks from Centre Square in Easton Pa serves traditional Tuscan fare including wood-fired pizza. If you are a nonresident you are not liable for New York City personal income tax but may be subject to Yonkers nonresident earning tax if your income is sourced to. I grew up in a small town in Pennsylvania essentially right on the border of New Jersey along the Delaware river.

I work in new york but live in pa. Employers in Philadelphia PA typically pay -110 less than employers in New York NY. I pay state taxes at the NY State rate and at the end of year when I do my taxes I somehow get a credit from NY for essentially the difference between NY and NJ rates.

New Jersey has a reciprocal tax agreement with Pennsylvania but. New York taxes you as a nonresident and PA taxes you as a resident. A federal tax return.

The typical home value is 417652. You probably wont want to though. In short youll have to file your taxes in both states if you live in NJ and work in NY.

Your City wage tax would be around 1950. When I was a small kid my father commuted from our town to his job in. Youll need to estimate how much your PA tax for the year will be after deducting the credit for NY taxes on your wages and make the appropriate quarterly payments.

13 hours agoEaston Pa. Your NY tax was 2500 and your PA tax was 1500. As a nonresident you only pay tax on New York source income which includes earnings from work performed in New York State and income from real property located in the state.

Im paying taxes in nyc but dont live therThe taxes im talking about is state and local. If you live in Delaware or New York and work in Pennsylvania your resident credit is limited to the lesser of the Pennsylvania tax you paid on the compensation. 1005 Maryland Ave Croydon PA 19021-7525 is a single-family home listed for-sale at.

Everyone who lives out of the city but works here should be charged an appropriate tax to cover these expenses. Like most US States both New York and New Jersey require that you pay State income taxes. Some states have reciprocal tax agreements allowing you only to pay taxes in your home state.

On your PA return theyll figure out your PA tax and then theyll apply a formula to credit you for the taxes you paid to New York State. You pay state and federal taxes in the State of PA on total income. However the Wynne decision may hold that you get to use the excess NY state tax of 1000 to reduce your city wage tax.

With that said if youre working in New York and living in New Jersey youll need to file two state tax returns. Philadelphia law says you need to pay a tax of 1950. There is not a single deduction for NY Wh on my pay stubs.

If you live in Delaware or New York and work in Pennsylvania your resident credit is limited to the lesser of the Pennsylvania tax you paid on the compensation.

1 000 Trees Board Package Gogreen Boardpackage Nyc Luxury Realestate Office Team Packaging Event

Live In Nj And Work In Nyc Where Do I Pay Taxes Streeteasy

New The 10 Best Home Decor With Pictures Final Days Tax Season Sale We Deliver An Assemble To Ny Nj Ct Pa Ma Ri D Glamorous Furniture Furniture Decor

Heavy Duty Recliner Chairs Free Shipping No Sales Tax Some States No Interest Financing Add To Cart For Deals O Recliner Chair Oversized Recliner Recliner

Best Places To Live In Reading Pennsylvania

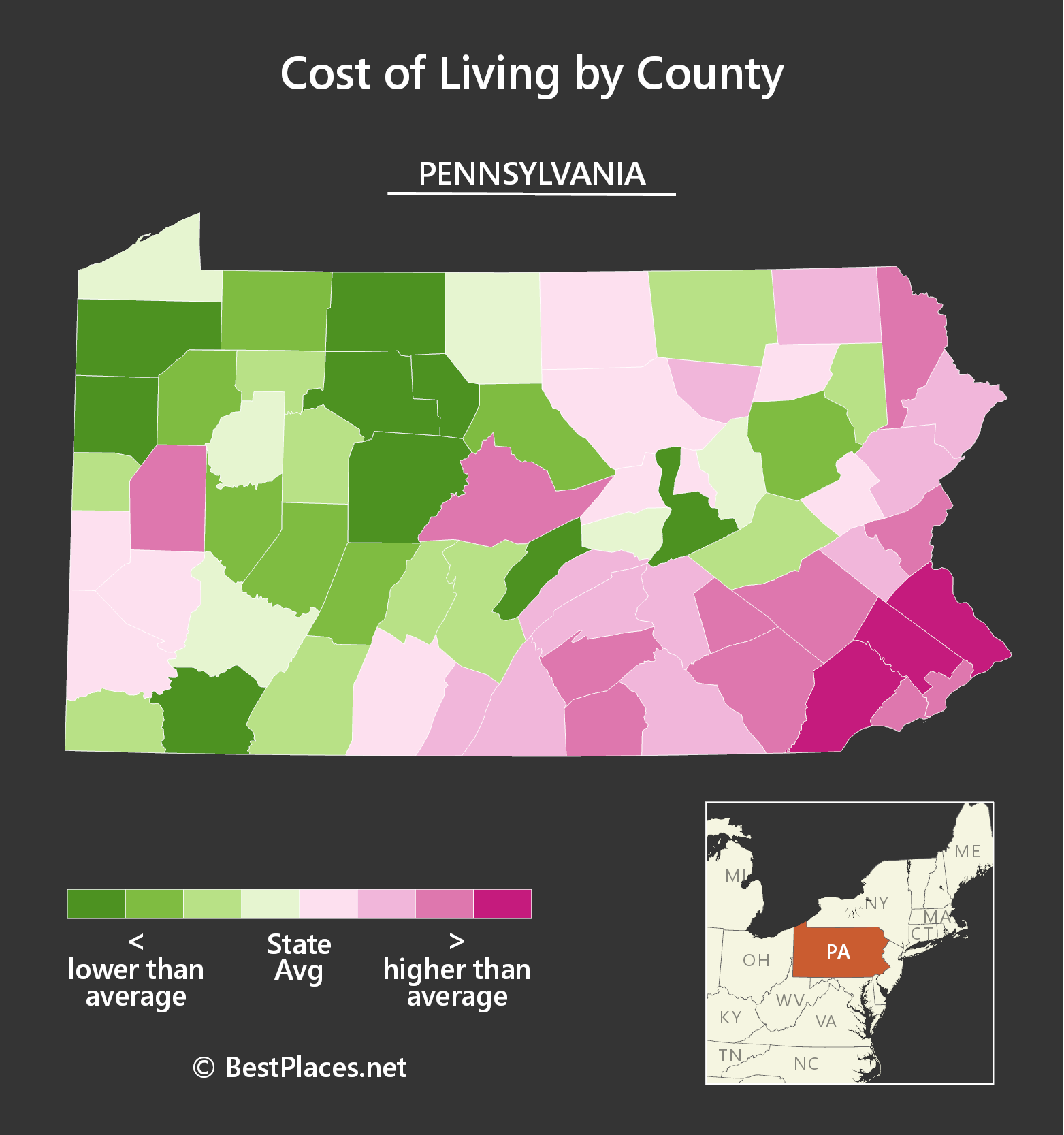

10 Most Affordable Places To Live In Pennsylvania On Q

21 Pros And Cons Of Living In Pennsylvania Vittana Org

Yankee Doodle Diner East Stroudsburg Pa Usa Stroudsburg Diner East Stroudsburg

Yardley Pa An Affordable Option Between New York And Philadelphia The New York Times

Village Cigars 110 7th Avenue S Christopher Walken In Next Stop Greenwich Village 1976 With Ellen Greene Lenny Baker Antonio Fargas And Dori Brenn Fotos

Evaluating Where To Retire Pennsylvania Vs Surrounding States Rodgers Associates

Ordinary Has No Home At The All New Residences At W Fort Lauderdale Signature Living In An Iconic Landmark With The Hotel W Fort Lauderdale Hotels And Resorts

Encuentre El Mejor Catalogo De Relojes Billeteras Lentes De Sol Y Carteras Fossil A Los Mejores Precios En Youroutlet Pe Tambien Winfield Nyc Fossil

Pin By Janekee Allen On Janekee Allen In 2022 Tax Prep Filer Prepping

Guide To Local Wage Tax Withholding For Pennsylvania Employers

Best Places To Live In Pennsylvania To Commute To New York City

When Do I Owe A Realtor A Commission Hauseit Nyc Real Estate Contract Sell My House Nyc Real Estate